About me

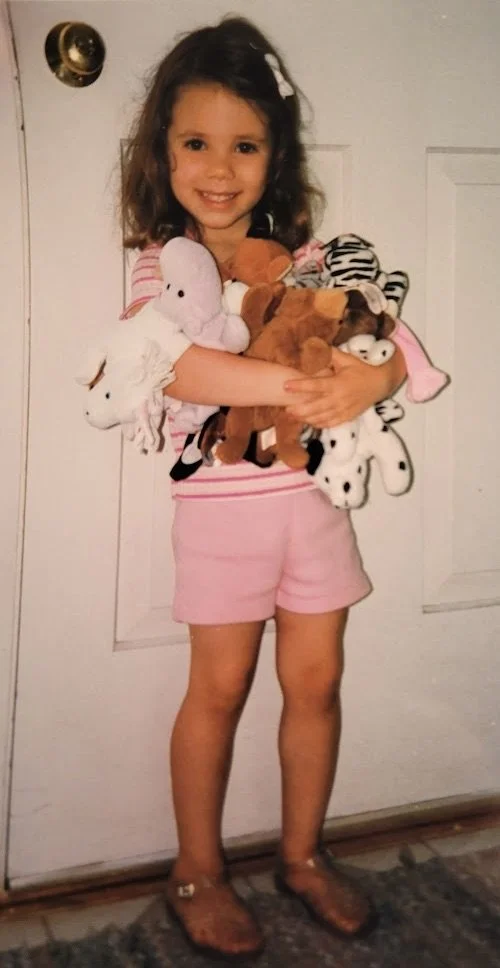

As a kid growing up in the 1990s, the Beanie Baby was King. My parents taught me how to budget my allowance using my “Beanie Baby Bank”. I quickly learned that if I saved my allowance for a few weeks, then I could buy any Beanie Baby I wanted. These values of saving my money and only spending on things I cared about were valuable lessons that I carried with me into adulthood.

After graduating college, I moved abroad to Ecuador and started working my first full time job as an English teacher.

Although I’d worked many jobs in my teens & college years, the money I earned was mostly for social spending - clothes, dinner out with friends, or going to the movies.

But as I started working my first full time job, I realized that I needed the money I made to support myself. It paid my rent and purchased groceries. My teaching salary wasn’t enough and I began to struggle to pay for all my life’s necessities.

For the first time in my life working for money, spending wisely and saving “The Rest” wasn’t enough to get by. I was eating into my savings quickly and needed a better solution.

I got a second job and started tracking my expenses, but one day at 25 years old, I woke up and asked myself “What if saving “the rest” is never enough?”

So I began reading every personal finance book I could find to educate myself on money management.

Over the following years, I learned about emergency savings, retirement accounts, investing in the stock market, and so much more. Although I’m not financially independent yet, I know that by educating myself about how money works and starting to save for retirement in my twenties, I am setting myself up for a successful future.

Now, I work to make financial education more accessible and easy for others to learn. Personal finance and the way you control your money depends on you.

Your happier, more financially stable future is out there, and I hope the resources I provide can help you move towards it, even if it’s imperfectly.

Remember, money touches every aspect of our lives. Where we live, what we eat, where we work, is all affected by money. But at the end of the day, money itself means very little. But what money can buy you - a spontaneous trip to the beach with your partner, books for your daughter, healthy food for your family, and the peace of mind of knowing your financial future will be stable and secure? Priceless.

Your life may not be perfect, but it is imperfectly yours. The only way to live it is your way.