How to read your credit card statement

Do you dread your next credit card statement? Have you ever opened up your statement and said - what am I even looking at?

There are a bunch of charts and numbers, followed by a page of tiny font with legal information - boring!

But credit cards are confusing on purpose. Credit card companies want you to overspend and underpay because they make most of their money off you paying interest on credit card debt. Do you know what the best credit card hack is? Paying your balance! The banks lose and you win.

I’m going to break down everything you find on your statement, so you understand how to read your credit card statement and how to pay your credit cards the right way.

The Account Summary

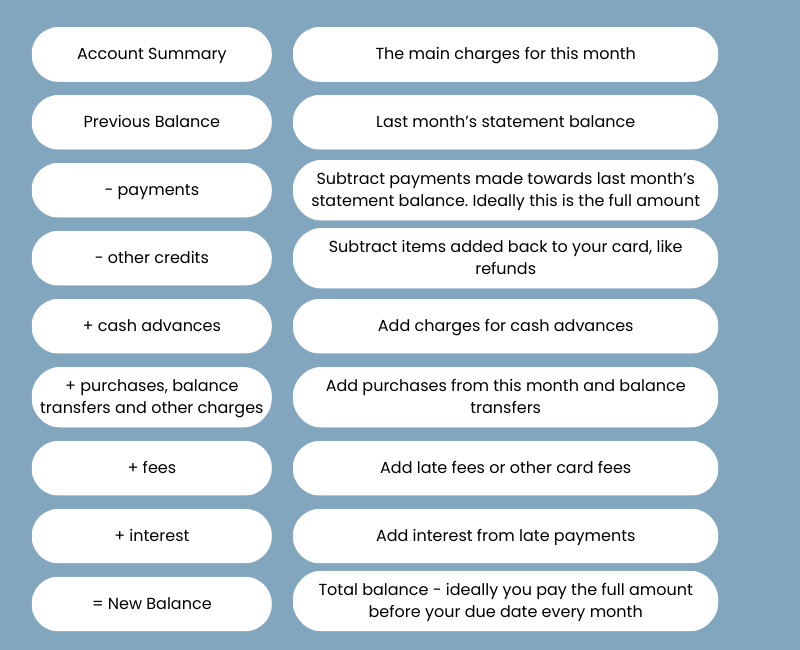

First, when you open your credit card statement, you’ll find a little chart that looks like this:

Every credit card statement will have a little chart on the first page with this information. It’s important to know how much your balance is and how much you are paying in fees.

Here’s what those things actually mean:

You should see all of these terms & numbers in the account summary section of your credit card statement. Usually it’s on the top of the first page.

Important Items To Look For

After looking through the account summary, you should check a few other important items:

Payment due date - This is the date in which you must have made at least the minimum payment. Most cards allow you to choose any payment date you want. Making all of your credit card due dates on the same day every month is a great way to keep your cards organized and ensure that you don’t miss any payments.

Minimum payment - The minimum amount you must pay in order to not have late fees or hits to your credit score. BUT, you should do everything you can to pay more than the minimum payment. Most credit cards have interest rates from 16%-28%, meaning if you spend $1,000 on your credit card and don’t pay the balance, you will owe an extra $160-$280 next month. For every month that you don’t pay the balance, it grows larger and larger, which is why it is so hard to get out of credit card debt once you have it. This is called compound interest.

Billing cycle - Usually around 31 days, you must pay for all the purchases you made within your billing cycle by the payment due date. For example, if your billing cycle is April 7-May 7th and your due date is June 1st, you must pay for any purchases made between the dates of April 7 to May 7 by June 1st. Any charges made after May 7 will be included in your next bill. You can find your billing cycle at the top of your statement.

Transactions - Your transactions are the purchases or charges to your card. It’s important to look through your transactions before paying your bill. If your card information has been stolen or if there are any unauthorized purchases on your card, you should report them to your credit card company before making payment. This is easy to do online or by calling your company.

Additional Items

Credit limit - The total amount of money that the credit card company is willing to let you use each month. It is a bad idea to get close to this number. Ideally, you should spend 10% or less of your total credit limit each month. Running a high balance on your credit card, even if you pay it off each month, can negatively impact your credit score.

Available credit - Your credit limit minus purchases made this month. If your credit limit is $10,000 and you’ve spent $2,000, then your available credit is now $8,000 until you make a payment.

Cash advance - When you withdraw cash by borrowing against your credit card. This feels similar to taking out cash with your debit card, except with your debit card you are taking out your own money from your checking account. In a cash advance you are borrowing money from your credit card, and being charged extremely high interest rates to do it (usually around 30%). Look for the interest rate at the bottom of your statement. Avoid cash advances at all costs.

Credit card statements can be very confusing. They have a lot of numbers, percentages and confusing legal text. Understanding the terms on your credit card statement will help you understand how much you owe and when you have to make payment to avoid hefty fees. Remember, the best way to use a credit card is by paying it off every single month.

Action steps:

Open your most recent credit card statement and check for any fees or interest. What fees are you paying and why? What is your interest rate? If you don’t know, call your credit card company and ask.

What was the last balance on your card, and did you pay off the full amount? If not, what can you do to pay the balance off more quickly?

Check your transactions. Remember to check your transactions before making payment. Report any fraud or unauthorized transactions to your credit card company.

Your life may not be perfect, but it is imperfectly yours. The only way to live it is your way.