What Types of Retirement Accounts are Available to Me?

Retirement is so far away. I don’t have to think about it now.

I want to start saving for retirement, but I don’t know how.

Retirement? That will never happen for me.

Do any of these sound like you? Retirement can seem like such a far off place that it’s easy to brush it aside as something that you’ll worry about later. But the reality is that retirement will be the biggest expense of your life. You will pay more for your retirement than a house, your college education, your car, your luxury vacation or your designer shoe collection. Retirement is expensive. Saving early and saving enough is important; and luckily for us, the IRS encourages us to save for retirement by providing us tax-advantaged accounts to do so. The accounts I discuss below are not a complete list of all retirement accounts, but they are some of the most common ones.

401k & 403b

A 401k is a retirement account that is usually linked to your job. It allows you to make contributions directly from your paycheck (often pre-tax). Additionally, many employers will match your contributions up to a certain percentage (usually 3-4%). For example, if you make $50,000/year and contribute 3% of your salary to your 401k ($1,500/year), then your employer will also contribute $1,500, meaning you get $3,000 for your account.

For companies that offer an employee match 401k benefit, you can sometimes double your annual contributions.

A 401k is typically used with for-profit companies, whereas a 403b account is often used for public school teachers, non-profit employees and other public servants. Otherwise, they mostly work in the same way.

Because the IRS gives tax-advantages to retirement accounts, there are limits to how much you can contribute. For 2024, that amount is $23,000. For the most recent limits, check the IRS.gov webpage.

IRAs

There are a few different types of IRAs (Individual Retirement Accounts). An IRA is often separate from your employer, meaning it isn’t tied to a specific job. However, to be eligible for an IRA you must have taxable income, meaning you work a job in the United States and pay income taxes on it. The most common accounts are Traditional and Roth and the main difference between them is taxes.

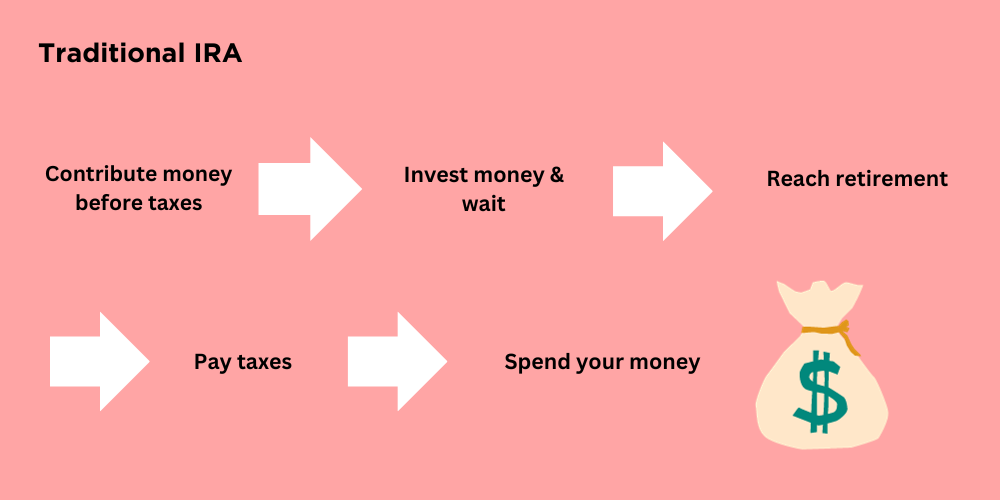

In a Traditional IRA, you contribute from your paycheck before you pay taxes. Then when you retire and are ready to use that money, you take it out and pay income taxes. The benefit of a Traditional IRA is that it can lower your tax responsibility today. The amount of money contributed to your Traditional IRA is deducted from your taxable income, meaning your salary is less and you pay less in taxes.

Traditional IRA you make contributions pre-tax, then pay taxes when withdrawing the money at retirement.

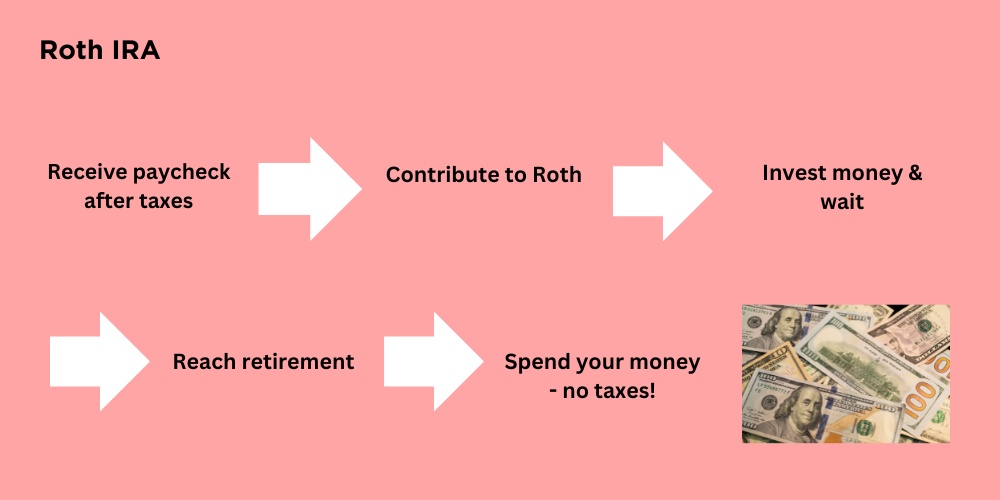

In a Roth IRA, you make contributions after paying taxes. So you get your paycheck, pay health insurance, taxes, any other benefits and then contribute to your Roth IRA. While you don’t get any tax benefits today, you do get them in the future. Your Roth IRA contributions can grow and grow and grow and grow and you don’t have to pay taxes when you take the money out!

Roth IRA you make contributions post-tax, but you do not have to pay any additional taxes at retirement. This means any growth from your investments is tax-free!

Like the 401k, IRAs also have contribution limits. In 2023, the maximum contributions were $6,500 across all accounts for anyone under 50. Meaning, if you have multiple IRAs, you can only contribute $6,500 total.

For more detailed information about these accounts, check out Traditional v. Roth IRA.

401k v. IRA

One difference between the 401k and IRAs is that the 401k is usually linked to your employer. So if you leave your job, or are let go, you can no longer contribute to that account. The money still belongs to you, but you’ll either have to let it sit there, or do what’s called a Rollover IRA, where you take the 401k from your job and move it to an IRA, deferring taxes in the process (if you’re interested in doing this, I recommend contacting your bank directly to make sure it’s done properly).

An IRA, on the other hand (Traditional or Roth) only depends on you having taxable income. As long as you have a job, any job, and pay income taxes you can contribute to these accounts.

Another important note, because the 401k and IRAs are different types of accounts, you can contribute up to the maximum amount in both accounts every year. So for 2023, you could contribute $22,500 to your 401k AND $6,500 to your Roth or Traditional IRA. This means you could save up to $29,000 in tax-advantaged accounts every year.

Both 401k and IRA accounts are tax advantaged accounts made to help you save for retirement.

Taxable investing accounts

If you already contribute the maximum to your 401k and your IRA and you still have extra income you want to invest, then you are incredible! Your next step is to open a taxable investing account, called a brokerage account. You can often invest in a brokerage account in a very similar way to your 401k or IRA account, but the difference is the government does not give any special tax advantages. Any growth that your money has within that account (which I hope it has!) will be taxed at your current tax bracket. Still, if you’ve already maxed out your other retirement accounts and are looking to continue growing your money, taxable accounts can be a great place to go.

Action Items

Does your employer offer a 401k? If yes, do they also offer a contribution match? If you’re not sure, contact your HR department.

Do you have a Traditional IRA or a Roth IRA? If not, call your bank and talk about opening one. Remember, maximum contributions are $6,500 (in 2023) across all accounts.

This article is about some of the most common types of retirement accounts, but it is not an exclusive list. For information about some of the other types of retirement accounts, you can visit the IRS.gov webpage or speak with a certified financial planner (CFP).

Your life may not be perfect, but it is imperfectly yours. The only way to live it is your way.